Once the trial sheet is prepared then, it becomes easy to prepare a balance sheet and income statement of the business. Let us have another example by preparing a trial sheet which proves that the total of debits is always equal to the total of credits.Īccounting equation gives rise to the balance sheet. Similarly, we can also record the transactions for the other accounting elements.

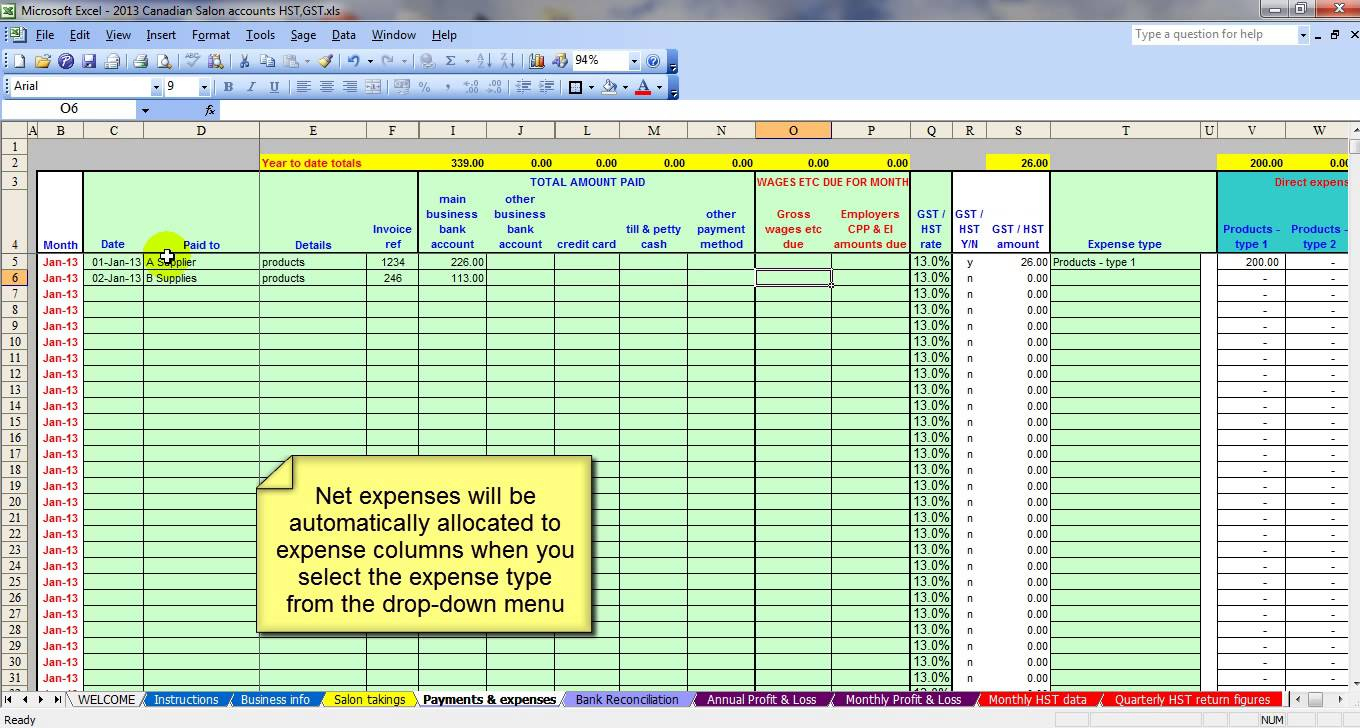

Tutorial for double entry bookkeeping how to#

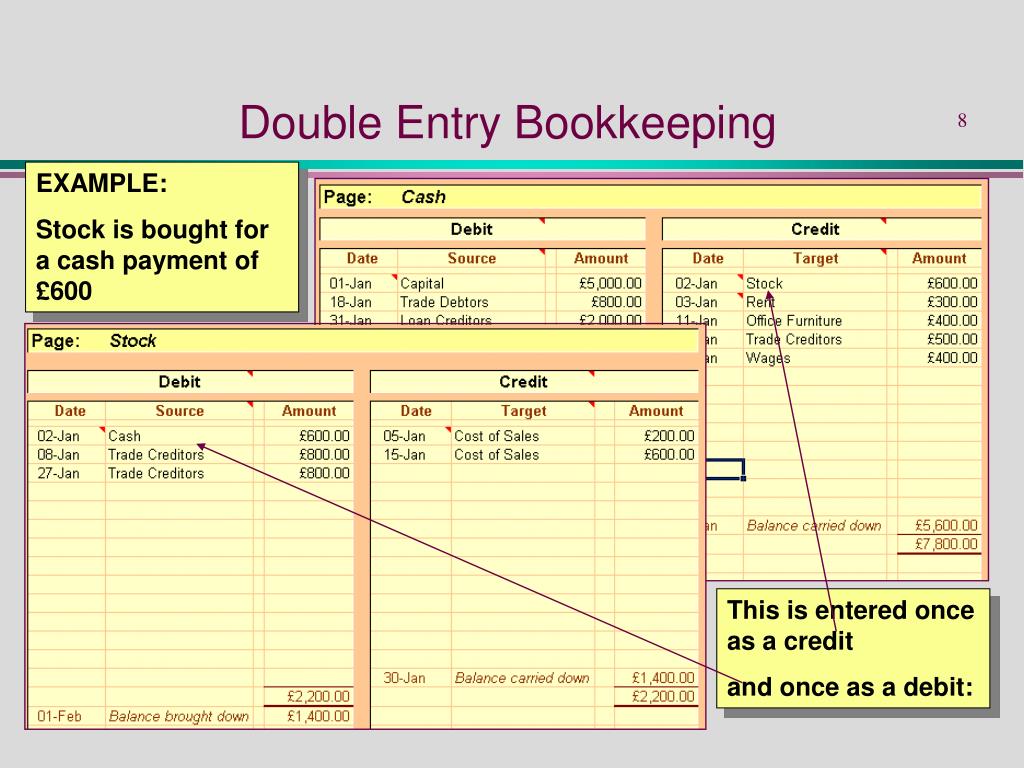

Gives the information that how to improve the financial position of the business.Records help in comparison to the current year’s result with those of the previous years, which help the owner to judge the progress of the business.Transactions are recorded in a systematic manner so, that it provides the most reliable or accurate information which helps in controlling the business or organization more efficiently and effectively.Helps in getting knowledge of business’s losses and profits.We can check the accuracy of the account book by preparing a trial balance at any time.From Double Entry System we can get information about the financial position of the business.The double-entry system gives us a complete record of all transactions that have been made.The main advantages of Double Entry System are –.You can remember it as A, E the starting alphabets of the vowels and L, I, C as it stands for the famous LIC company. Capital decreases debit – capital increases credited.Income decreases debited – income increases credited.Liabilities decreases debited – liabilities increases credited.Expenses increases debited – expenses decrease credited.Assets increases debited – assets decreases credited.Here, cash is debited or increased while goods are credited or decreased by the same amount. someone increases and someone decreases.Įxample: Sold goods for cash 3,2000.

Nominal, income & expenditure account: Account which is related to the expenses and loses is to be debited whereas the account which is related to the income and gains is to be credited.įor every transaction, these elements are changed i.e. Real or Asset account: This rule said that an asset that comes to the business by the transaction is to be debited whereas the asset that goes out of the business by the transaction is to be credited.ģ. Personal account: This rule said that if a person or institution who receives a benefit is to be debited whereas if a person or institution who gives a benefit is to be credited.Ģ. Nominal or Income – Expenditure account.ġ.The accounting process is based on the three rules which are separated to each other by the three classes of accounts:. So, here Ĭredit = 4,000 Synonyms of double-entry systemĭouble-entity system, double-entry bookkeeping, double inlet, double feed, double entries, double-stranded part RULES OR PRINCIPLES OF DOUBLE-ENTITY SYSTEM How to use Microsoft Excel - The Complete Tutorial for Excel Sheet CalculationsĮxample of Double-Entry System: A business purchases goods for cash Rs 4,000/.The double-entry system explains to us that for every debit there is corresponding credit for an equal amount of money while for every credit there is the corresponding debit for an equal amount of money. The two facts involved in accounting which results in a double-entry system are: SINGLE-ENTRY SYSTEM VS DOUBLE-ENTRY SYSTEM.RULES OR PRINCIPLES OF DOUBLE-ENTITY SYSTEM.

0 kommentar(er)

0 kommentar(er)